Charitable Remainder Trusts

(CRT)

In 1969 Congress created a new type of trust that helped charities and not-for-profit organizations generate more revenue for their causes. In addition to being an excellent vehicle to make a charitable gift or bequest, a charitable remainder trust is an effective estate planning and income tax reduction tool. This vehicle allows taxpayers to reduce estate taxes, eliminate capital gains, claim an income tax deduction, and benefit charities instead of the IRS.

Estate Planning:

What is it and why do we do it?

You spend your entire life creating wealth. The more wealth you create the more unhappy the people you leave behind will be without the proper estate planning. Estate planning allows you to decide while you are alive how your assets will be distributed. It also allows you to protect your heirs from unanticipated devastating expenses ranging from debts to taxes to administrative fees.

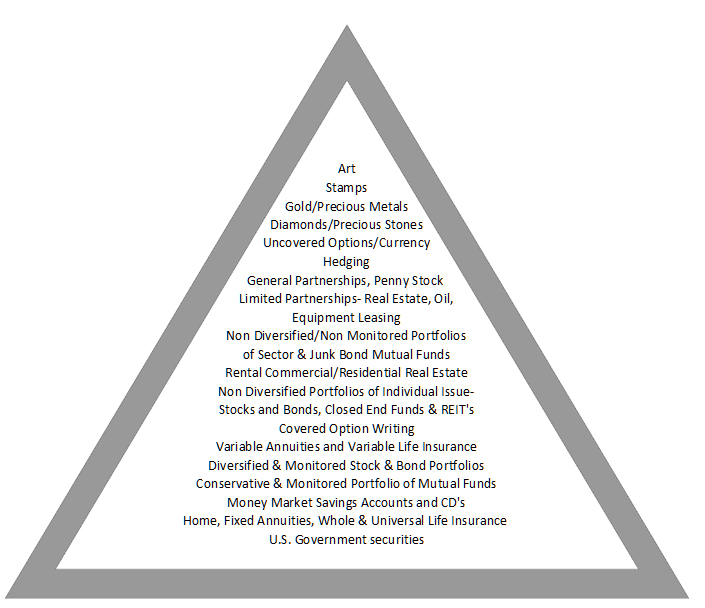

High Risk

|

Low Risk

Investment Pyramid

The above is a simple chart of Investment categories by risk and reward. It is in the shape of a pyramid. With Investments at the top of the pyramid an individual can expect the greatest returns but because of the risk associated with these investments an individual can also experience the greatest risk of loss. Volatility is the key. If you knew exactly when to invest in high risk areas and exactly when to sell, then you should experience the highest returns. Consequently, with the investments at the bottom of the pyramid you would expect low returns with little risk of loss of investment. The placement of investment vehicles on the pyramid is subjective and opinions as to their placement could vary.